ATA Local #23 Information Update - November 2, 2023

WORTH KNOWING

#1 - Criminal Record Check - Bill 85

The January 1, 2024 deadline to have a new criminal record check submitted to your employer is quickly approaching.

Last September, Bill 85 amended the Education Act and created a new requirement for updated criminal records and vulnerable sector checks for teachers. Individuals employed by a school board whose employment requires a certificate of qualification as a teacher, a leadership certificate, or a superintendent leadership certificate must submit a new record check every five years.

Key Details:

Who Is Affected? Bill 85 applies to those whose roles require any of the above listed certificates.

Deadline: Teachers need to provide the checks to their division by January 1, 2024 to avoid potential issues. The checks must then be updated every five years.

Timelines: Law enforcement agencies may need time to process record check applications. If you have not already submitted your application, you should act now without delay.

Non-Compliance: Failure to provide the necessary checks within the specified timeframe, without clear evidence of steps taken to obtain them, may result in significant employment-related issues.

Cost: Teachers are not required to bear the cost of the five-year criminal record check. Many divisions have collaborated with local law enforcement detachments to facilitate the process. However, teachers who cannot provide the checks due to reasons such as document loss, missed deadlines, or new employment will be responsible for the cost of the initial check or its reissuance.

Responsibility: School divisions are responsible for enforcing this legislation and ensuring that the results of these checks confirm the suitability of the teacher for their position.

Criminal Conviction Disclosure: If you have a criminal charge or conviction and have not reported this to your employer, we recommend seeking advice from Teacher Employment Services (1-800-232-7208). Proactively addressing this issue with your school division is advisable, especially if it may impact your updated criminal record and vulnerable sector check submission.

We understand that this may raise questions, and we are here to support you through this process. If you have any inquiries or require clarification, please do not hesitate to contact us.

Thank you,

The Alberta Teachers’ Association

#2 - Teacher Employment Services (TES) - Critical Illness Insurance

WORTH KNOWING

Critical Illness Insurance

Critical illness insurance is not something you want to think about. But it is protection you want to have should you become critically ill and no longer able to work. Money is one of the last things you want to have to worry about if you are diagnosed with cancer or suffer a heart attack, but a serious illness can devastate your finances.

Optional critical illness insurance can help with your finances while you focus on your recovery. It is one of the most cost-effective things you will ever do to protect your savings.

This type of insurance can give you a tax-free payment if you are diagnosed with a serious medical condition. Your contract will define which conditions are covered, but examples include cancer, heart attack and stroke.

Many assume that the Alberta Health Care Insurance Plan or workplace benefit plans (such as the Alberta School Employee Benefit Plan [ASEBP]) will cover many of the additional medical costs associated with a life-altering illness. However, these plans might not cover all the extra costs that come with managing a critical illness, such as home care, travel and accommodations, lost work wages, childcare, gas and meals. Over time, these expenses can add up.

Capital Estate Planning provides the Association’s Voluntary Benefits Program, a unique program built specifically for Alberta teachers and their families. This program includes critical illness insurance, group savings plans (RRSP, TFSA, RESP and RRIF), additional life insurance, and mortgage insurance.

Until November 30, 2023, teachers can apply for up to $50,000 in guaranteed acceptance critical illness insurance for themselves and up to $10,000 for their children. No medical questions are asked, and acceptance is guaranteed, regardless of medical history.

For more information, visit https://specialmarkets.ia.ca/applyata/home or call Capital Estate Planning at 780-463-6128 or 1-800-661-8755.

WORTH SHARING

A critical illness can devastate your finances. When you are sick, money is the last thing you want to consider. Critical illness insurance can help cover your costs. Visit https://specialmarkets.ia.ca/applyata/home or call Capital Estate Planning at 780-463-6128 or 1‑800-661-8755. #WEAREATA

#3 - TES - Criminal Record Checks

Criminal and Vulnerable Sector Checks—Time Is Running Out!

Effective September 1, 2022, Bill 85 amended the Education Act by adding a requirement to have updated criminal records and vulnerable sector checks. Section 2(7) of Bill 85 amended the Education Act by adding section 229.1, Criminal Record and Vulnerable Sector Checks. Bill 85 applies to those whose employment requires a certificate of qualification as a teacher, aleadership certificate or a superintendent leadership certificate. The legislation requires that the checks be completed by January 1, 2024 and must be updated every five years.

All school divisions must enforce the legislation and are required to ensure the results of those checks demonstrate that the teacher continues to be suitable for employment in their position. Failure to provide the necessary checks by the deadline imposed by the legislation, without some clear and demonstrable proof of the steps taken to obtain them, may result in a member encountering significant issues related to their employment relationship with their division. Teachers must comply with the legislation by providing the checks, even if their division has not offered a method or system to address the requirements.

Teachers do not have to incur the cost of the five-year criminal record check. Many divisions have worked with local law enforcement detachments to provide opportunities for members to obtain the checks. However, teachers who cannot provide the checks due to loss of the documents or failure to pick up or download them by the issuing agency’s deadline or starting new employment will be responsible for the cost of the initial check or its reissuance.

If you have a criminal conviction (or charge, subject to the terms of your employment contract) and failed to report this toyour division, you should seek the advice of Teacher Employment Services (1-800-232-7208). In this situation, most memberswould benefit from proactively addressing the issue with their division rather than waiting until their updated criminal record and vulnerable sector check is submitted.

WORTH SHARING

The deadline of January 1, 2024, is fast approaching for compliance with the Education Act to provide updated criminal and vulnerable sector checks. Teachers need to provide the checks to their division by the deadline to avoid potential issues. Contact Teacher Employment Services for more assistance. #WEAREATA

#4 - Calgary Public teachers - Going Home Reflections

We’d like to share a new resource, designed for school staff, called Going Home Reflections. Please help us share this widely with schools across Alberta.

Goals of Going Home Reflections:

Please visit these links to view and download all the materials you will need to use this free resource.

#1 - Criminal Record Check - Bill 85

The January 1, 2024 deadline to have a new criminal record check submitted to your employer is quickly approaching.

Last September, Bill 85 amended the Education Act and created a new requirement for updated criminal records and vulnerable sector checks for teachers. Individuals employed by a school board whose employment requires a certificate of qualification as a teacher, a leadership certificate, or a superintendent leadership certificate must submit a new record check every five years.

Key Details:

Who Is Affected? Bill 85 applies to those whose roles require any of the above listed certificates.

Deadline: Teachers need to provide the checks to their division by January 1, 2024 to avoid potential issues. The checks must then be updated every five years.

Timelines: Law enforcement agencies may need time to process record check applications. If you have not already submitted your application, you should act now without delay.

Non-Compliance: Failure to provide the necessary checks within the specified timeframe, without clear evidence of steps taken to obtain them, may result in significant employment-related issues.

Cost: Teachers are not required to bear the cost of the five-year criminal record check. Many divisions have collaborated with local law enforcement detachments to facilitate the process. However, teachers who cannot provide the checks due to reasons such as document loss, missed deadlines, or new employment will be responsible for the cost of the initial check or its reissuance.

Responsibility: School divisions are responsible for enforcing this legislation and ensuring that the results of these checks confirm the suitability of the teacher for their position.

Criminal Conviction Disclosure: If you have a criminal charge or conviction and have not reported this to your employer, we recommend seeking advice from Teacher Employment Services (1-800-232-7208). Proactively addressing this issue with your school division is advisable, especially if it may impact your updated criminal record and vulnerable sector check submission.

We understand that this may raise questions, and we are here to support you through this process. If you have any inquiries or require clarification, please do not hesitate to contact us.

Thank you,

The Alberta Teachers’ Association

#2 - Teacher Employment Services (TES) - Critical Illness Insurance

WORTH KNOWING

Critical Illness Insurance

Critical illness insurance is not something you want to think about. But it is protection you want to have should you become critically ill and no longer able to work. Money is one of the last things you want to have to worry about if you are diagnosed with cancer or suffer a heart attack, but a serious illness can devastate your finances.

Optional critical illness insurance can help with your finances while you focus on your recovery. It is one of the most cost-effective things you will ever do to protect your savings.

This type of insurance can give you a tax-free payment if you are diagnosed with a serious medical condition. Your contract will define which conditions are covered, but examples include cancer, heart attack and stroke.

Many assume that the Alberta Health Care Insurance Plan or workplace benefit plans (such as the Alberta School Employee Benefit Plan [ASEBP]) will cover many of the additional medical costs associated with a life-altering illness. However, these plans might not cover all the extra costs that come with managing a critical illness, such as home care, travel and accommodations, lost work wages, childcare, gas and meals. Over time, these expenses can add up.

Capital Estate Planning provides the Association’s Voluntary Benefits Program, a unique program built specifically for Alberta teachers and their families. This program includes critical illness insurance, group savings plans (RRSP, TFSA, RESP and RRIF), additional life insurance, and mortgage insurance.

Until November 30, 2023, teachers can apply for up to $50,000 in guaranteed acceptance critical illness insurance for themselves and up to $10,000 for their children. No medical questions are asked, and acceptance is guaranteed, regardless of medical history.

For more information, visit https://specialmarkets.ia.ca/applyata/home or call Capital Estate Planning at 780-463-6128 or 1-800-661-8755.

WORTH SHARING

A critical illness can devastate your finances. When you are sick, money is the last thing you want to consider. Critical illness insurance can help cover your costs. Visit https://specialmarkets.ia.ca/applyata/home or call Capital Estate Planning at 780-463-6128 or 1‑800-661-8755. #WEAREATA

#3 - TES - Criminal Record Checks

Criminal and Vulnerable Sector Checks—Time Is Running Out!

Effective September 1, 2022, Bill 85 amended the Education Act by adding a requirement to have updated criminal records and vulnerable sector checks. Section 2(7) of Bill 85 amended the Education Act by adding section 229.1, Criminal Record and Vulnerable Sector Checks. Bill 85 applies to those whose employment requires a certificate of qualification as a teacher, aleadership certificate or a superintendent leadership certificate. The legislation requires that the checks be completed by January 1, 2024 and must be updated every five years.

All school divisions must enforce the legislation and are required to ensure the results of those checks demonstrate that the teacher continues to be suitable for employment in their position. Failure to provide the necessary checks by the deadline imposed by the legislation, without some clear and demonstrable proof of the steps taken to obtain them, may result in a member encountering significant issues related to their employment relationship with their division. Teachers must comply with the legislation by providing the checks, even if their division has not offered a method or system to address the requirements.

Teachers do not have to incur the cost of the five-year criminal record check. Many divisions have worked with local law enforcement detachments to provide opportunities for members to obtain the checks. However, teachers who cannot provide the checks due to loss of the documents or failure to pick up or download them by the issuing agency’s deadline or starting new employment will be responsible for the cost of the initial check or its reissuance.

If you have a criminal conviction (or charge, subject to the terms of your employment contract) and failed to report this toyour division, you should seek the advice of Teacher Employment Services (1-800-232-7208). In this situation, most memberswould benefit from proactively addressing the issue with their division rather than waiting until their updated criminal record and vulnerable sector check is submitted.

WORTH SHARING

The deadline of January 1, 2024, is fast approaching for compliance with the Education Act to provide updated criminal and vulnerable sector checks. Teachers need to provide the checks to their division by the deadline to avoid potential issues. Contact Teacher Employment Services for more assistance. #WEAREATA

#4 - Calgary Public teachers - Going Home Reflections

We’d like to share a new resource, designed for school staff, called Going Home Reflections. Please help us share this widely with schools across Alberta.

Goals of Going Home Reflections:

- Provide tools to school staff that support a work-life balance

- Affirm the value of educators and the important role they play in the lives of children and youth, which further impacts the community

Please visit these links to view and download all the materials you will need to use this free resource.

- https://www.albertahealthservices.ca/amh/Page18509.aspx

- https://www.albertahealthservices.ca/amh/Page18516.aspx

- Going Home Reflections Promotion Poster

- Going Home Reflections Toolkit Guidebook

- Step by Step Guide

- Letting Go List from Jack James High School

- Letting go of the workday template

- Reflections 1 though 7

WORTH KNOWING

The Nature of Teaching Duties (Part 1)

Teaching duties are all the professional tasks encountered by teachers in the course of their activities related to the instruction of students, including

· conducting classes and presenting lessons,

· preparing lessons,

· requisitioning materials and equipment,

· evaluating and reporting on student progress and

· maintaining such classroom order as is necessary to promote a healthy learning climate.

Sections 196 and 197 of the Education Act form the legislative basis for these duties.

Education Act

196(1) A teacher while providing instruction or supervision must

(a) provide instruction competently to students;

(b) teach the courses of study and education programs that are prescribed, approved or authorized pursuant to this Act;

(c) promote goals and standards applicable to the provision of education adopted or approved pursuant to this Act;

(d) encourage and foster learning in students;

(e) regularly evaluate students and periodically report the results of the evaluation to the students, the students’ parents and the board;

(f) maintain, under the direction of the principal, order and discipline among the students while they are in the school or on the school grounds and while they are attending or participating in activities sponsored or approved by the board;

(g) subject to any applicable collective agreement and the teacher’s contract of employment, carry out those duties that are assigned to the teacher by the principal or the board.

(2) At any time during the period of time that a teacher is under an obligation to the board to provide instruction or supervision or to carry out duties assigned to the teacher by a principal or the board, a teacher must, at the request of the board,

(a) participate in curriculum development and field testing of new curriculum;

(b) develop, field test and mark provincial achievement tests and diploma examinations;

(c) supervise student teachers.

The Act further implies an expectation for teachers to carry out such general supervision of their students as may be required by law, by regulation or by agreement, in order to assist to a reasonable extent with the school program as agreed to by the staff. This expectation extends to cooperating with other teachers in the best interests of students and generally to acting as an engaged member of the school’s educational team.

While collective agreements provide Alberta teachers with limits on their assignable and instructional time, many duties required of teachers to fulfill their obligations fall into the category of professional time. In general, this professional time can be defined as the time that is directed by the teacher, including decisions about when and where the duties are done. Tasks that fall under professional time include the following:

· Marking

· Planning and creating instructional materials

· Personal professional development

Ø Reading

Ø Attending conferences and workshops

· Professional reflection

· Self-directed contact with parents outside assigned meetings and admin directive contact

· Providing additional assistance to students

· Collaborating with colleagues

The work time for these functions is not regulated in collective agreements, but they are obligations of the profession under the Education Act.

The Nature of Teaching Duties (Part 1)

Teaching duties are all the professional tasks encountered by teachers in the course of their activities related to the instruction of students, including

· conducting classes and presenting lessons,

· preparing lessons,

· requisitioning materials and equipment,

· evaluating and reporting on student progress and

· maintaining such classroom order as is necessary to promote a healthy learning climate.

Sections 196 and 197 of the Education Act form the legislative basis for these duties.

Education Act

196(1) A teacher while providing instruction or supervision must

(a) provide instruction competently to students;

(b) teach the courses of study and education programs that are prescribed, approved or authorized pursuant to this Act;

(c) promote goals and standards applicable to the provision of education adopted or approved pursuant to this Act;

(d) encourage and foster learning in students;

(e) regularly evaluate students and periodically report the results of the evaluation to the students, the students’ parents and the board;

(f) maintain, under the direction of the principal, order and discipline among the students while they are in the school or on the school grounds and while they are attending or participating in activities sponsored or approved by the board;

(g) subject to any applicable collective agreement and the teacher’s contract of employment, carry out those duties that are assigned to the teacher by the principal or the board.

(2) At any time during the period of time that a teacher is under an obligation to the board to provide instruction or supervision or to carry out duties assigned to the teacher by a principal or the board, a teacher must, at the request of the board,

(a) participate in curriculum development and field testing of new curriculum;

(b) develop, field test and mark provincial achievement tests and diploma examinations;

(c) supervise student teachers.

The Act further implies an expectation for teachers to carry out such general supervision of their students as may be required by law, by regulation or by agreement, in order to assist to a reasonable extent with the school program as agreed to by the staff. This expectation extends to cooperating with other teachers in the best interests of students and generally to acting as an engaged member of the school’s educational team.

While collective agreements provide Alberta teachers with limits on their assignable and instructional time, many duties required of teachers to fulfill their obligations fall into the category of professional time. In general, this professional time can be defined as the time that is directed by the teacher, including decisions about when and where the duties are done. Tasks that fall under professional time include the following:

· Marking

· Planning and creating instructional materials

· Personal professional development

Ø Reading

Ø Attending conferences and workshops

· Professional reflection

· Self-directed contact with parents outside assigned meetings and admin directive contact

· Providing additional assistance to students

· Collaborating with colleagues

The work time for these functions is not regulated in collective agreements, but they are obligations of the profession under the Education Act.

WORTH KNOWING

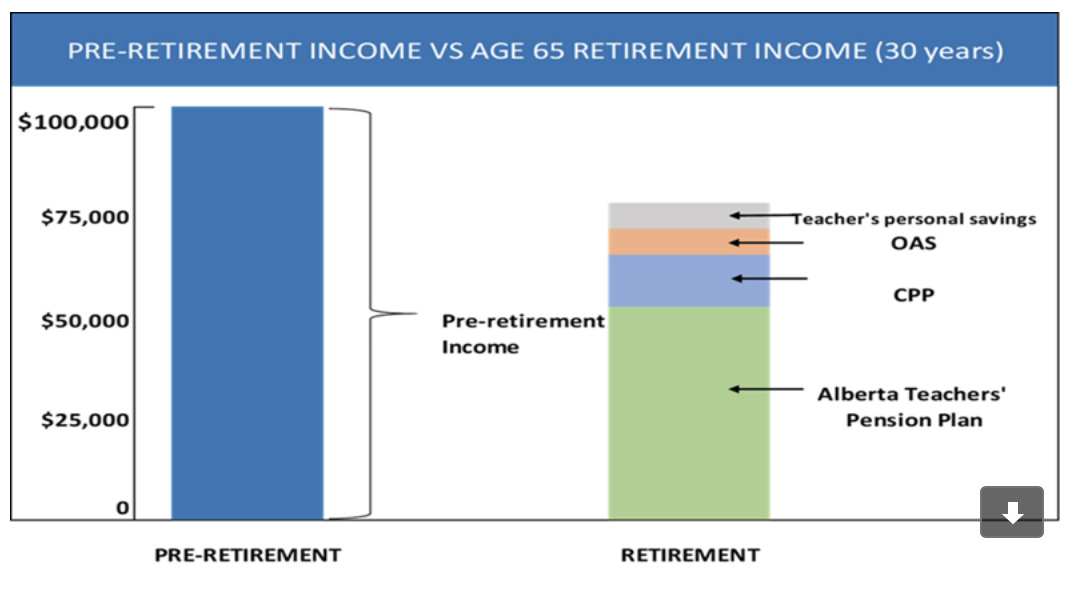

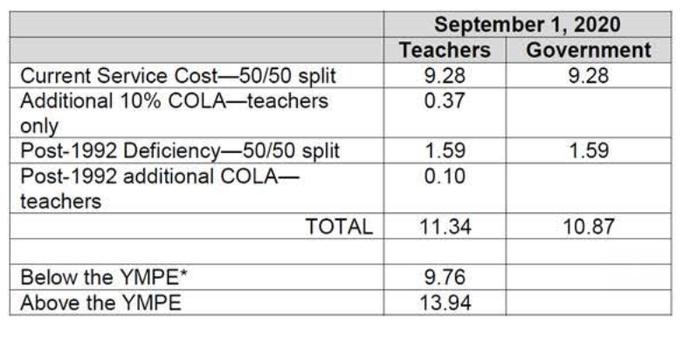

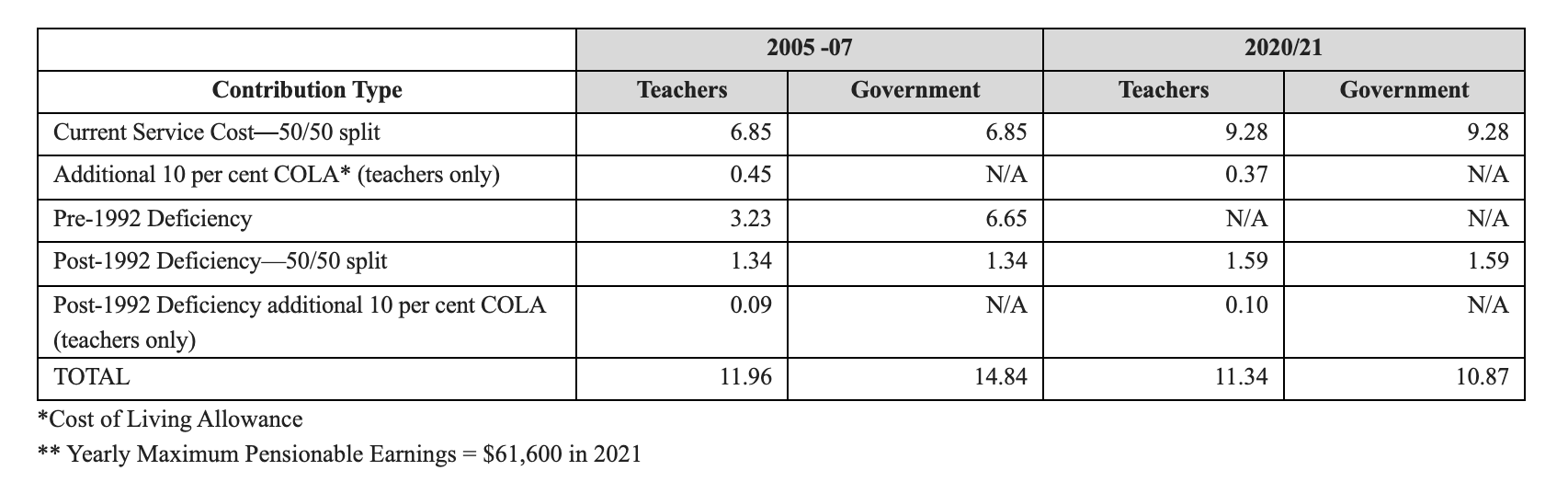

Pension Contribution Reductions for 2022

Every year the Alberta Teachers’ Retirement Fund (ATRF) develops an annual report that covers a wide variety of topics, including ATRF’s investment results, funding status, member services statistics and financial reporting. In 2021, ATRF continued to manage the challenges presented by the ongoing pandemic and the transfer of assets to the Alberta Investment Management Corporation (AIMCo), while still providing excellent service to members and excellent value for Alberta teachers and plan sponsors.

ATRF’s 2021 annual report, Together Through Change, provides teachers with detailed information on the following topics:

· ATRF’s performance and resilience over the past year during a period of major change

· A discussion of ATRF’s strategic plan

· Results from the most recent member survey

· Detailed information around plan structure and funding

· Funding objectives based on ATRF’s funding policy, and the funding status of the plans

· ATRF’s fund performance

· The transition of assets to AIMCo

· The announcement of another reduction in contribution rates

Management of Contribution Rates

Effective September 1, 2022, the total rates for the Teachers’ Pension Plan will be reduced by two per cent of salaries (one per cent for the Government of Alberta and one per cent for teachers). Several considerations went into this decision, including

· strong investment returns;

· prudent management that continues to build margins and reinforce the plan’s long-term sustainability; and

· the determination that the plan will be able to continue to meet funding objectives of benefit security, intergenerational equity, and contribution rate stability and affordability.

Managing the plan’s funded status requires making long-term decisions that maintain the health of the plan, with proactive measures in place in anticipation of future challenges. There are three main levers for the management of funded status of any pension plan. The first is the level and type of benefits offered, which are the plan sponsors’ decision. The ATRF board manages the two remaining levers to achieve long-term sustainability. First is the funding policy and setting the contributions paid by teachers and the government/employer, which determines how the plan is funded, and second is the investment policy, which sets out how the assets are invested. Contributions and investments provide capital with which to pay plan benefits as they become due and to fund the operations of ATRF.

Pension Contribution Reductions for 2022

Every year the Alberta Teachers’ Retirement Fund (ATRF) develops an annual report that covers a wide variety of topics, including ATRF’s investment results, funding status, member services statistics and financial reporting. In 2021, ATRF continued to manage the challenges presented by the ongoing pandemic and the transfer of assets to the Alberta Investment Management Corporation (AIMCo), while still providing excellent service to members and excellent value for Alberta teachers and plan sponsors.

ATRF’s 2021 annual report, Together Through Change, provides teachers with detailed information on the following topics:

· ATRF’s performance and resilience over the past year during a period of major change

· A discussion of ATRF’s strategic plan

· Results from the most recent member survey

· Detailed information around plan structure and funding

· Funding objectives based on ATRF’s funding policy, and the funding status of the plans

· ATRF’s fund performance

· The transition of assets to AIMCo

· The announcement of another reduction in contribution rates

Management of Contribution Rates

Effective September 1, 2022, the total rates for the Teachers’ Pension Plan will be reduced by two per cent of salaries (one per cent for the Government of Alberta and one per cent for teachers). Several considerations went into this decision, including

· strong investment returns;

· prudent management that continues to build margins and reinforce the plan’s long-term sustainability; and

· the determination that the plan will be able to continue to meet funding objectives of benefit security, intergenerational equity, and contribution rate stability and affordability.

Managing the plan’s funded status requires making long-term decisions that maintain the health of the plan, with proactive measures in place in anticipation of future challenges. There are three main levers for the management of funded status of any pension plan. The first is the level and type of benefits offered, which are the plan sponsors’ decision. The ATRF board manages the two remaining levers to achieve long-term sustainability. First is the funding policy and setting the contributions paid by teachers and the government/employer, which determines how the plan is funded, and second is the investment policy, which sets out how the assets are invested. Contributions and investments provide capital with which to pay plan benefits as they become due and to fund the operations of ATRF.

WORTH KNOWING

Eligible Educator School Supply Tax Credit (Line 46900) (AN UPDATE)

Unfortunately, it appears that teachers who claimed Line 46900--Eligible educator school supply tax credit (Line 46900) on their 2021 tax return will experience delays with their Notice of Assessment (and subsequent refunds).

The Canada Revenue Agency (CRA) has informed teachers who have inquired about their returns that they would not be processing the 2021 tax returns for anyone who has claimed Line 46900 until the Royal Assent of Bill C-8 has been passed. Bill C-8 includes an increase in the School Supplies Tax Credit from 15 per cent to 25 per cent. Based on inquiries by the Canadian Teachers’ Federation/Fédération canadienne des enseignantes et des enseignants (CTF/FCE), it appears that due to the combined effect of the late fall economic update that included the increased commitment, the late tabling of the bill to legislate the change and the minority government scenario, the government has been unable to pass this piece of legislation in the timeline they expected. As a result, teachers who claimed Line 46900 for their 2021 tax return should expect to see a delay of their Notice of Assessment.

The CTF/FCE has reached out to the Government of Canada to express their dissatisfaction that this expected delay was not communicated sooner and that other options outside of an indefinite delay until the Royal Assent of Bill C-8 were not explored. The CTF/FCE have written to staff in the Minister of Finance’s Office, the Minister of National Revenue’s Office and the Commissioner of Revenue’s Office. To date, only the Minister of National Revenue’s staff have responded and, while they recognized the severity of the issue and have agreed to provide support, they have encouraged the CTF/FCE to work directly with the Commissioner of Revenue.

If you are experiencing these delays, you are encouraged to contact the CTF/FCE’s Advocacy and Government Relations Coordinator, Mark Garcia via e-mail at [email protected].

Additionally, if you wish to express your concerns about these delays and the lack of communication from the CRA or the Government of Canada, you are encouraged to contact your local Member of Parliament to advocate for better channels of communication between the federal government and the CTF/FCE.

Eligible Educator School Supply Tax Credit (Line 46900) (AN UPDATE)

Unfortunately, it appears that teachers who claimed Line 46900--Eligible educator school supply tax credit (Line 46900) on their 2021 tax return will experience delays with their Notice of Assessment (and subsequent refunds).

The Canada Revenue Agency (CRA) has informed teachers who have inquired about their returns that they would not be processing the 2021 tax returns for anyone who has claimed Line 46900 until the Royal Assent of Bill C-8 has been passed. Bill C-8 includes an increase in the School Supplies Tax Credit from 15 per cent to 25 per cent. Based on inquiries by the Canadian Teachers’ Federation/Fédération canadienne des enseignantes et des enseignants (CTF/FCE), it appears that due to the combined effect of the late fall economic update that included the increased commitment, the late tabling of the bill to legislate the change and the minority government scenario, the government has been unable to pass this piece of legislation in the timeline they expected. As a result, teachers who claimed Line 46900 for their 2021 tax return should expect to see a delay of their Notice of Assessment.

The CTF/FCE has reached out to the Government of Canada to express their dissatisfaction that this expected delay was not communicated sooner and that other options outside of an indefinite delay until the Royal Assent of Bill C-8 were not explored. The CTF/FCE have written to staff in the Minister of Finance’s Office, the Minister of National Revenue’s Office and the Commissioner of Revenue’s Office. To date, only the Minister of National Revenue’s staff have responded and, while they recognized the severity of the issue and have agreed to provide support, they have encouraged the CTF/FCE to work directly with the Commissioner of Revenue.

If you are experiencing these delays, you are encouraged to contact the CTF/FCE’s Advocacy and Government Relations Coordinator, Mark Garcia via e-mail at [email protected].

Additionally, if you wish to express your concerns about these delays and the lack of communication from the CRA or the Government of Canada, you are encouraged to contact your local Member of Parliament to advocate for better channels of communication between the federal government and the CTF/FCE.

WORTH KNOWING

Eligible Educator School Supply Tax Credit (Line 46900)

Unfortunately, it appears that teachers who claimed Line 46900--Eligible educator school supply tax credit (Line 46900) on their 2021 tax return will experience delays with their Notice of Assessment (and subsequent refunds).

The Canada Revenue Agency (CRA) has informed teachers who have inquired about their returns that they would not be processing the 2021 tax returns for anyone who has claimed Line 46900 until the Royal Assent of Bill C-8 has been passed. Bill C-8 includes an increase in the School Supplies Tax Credit from 15 per cent to 25 per cent. Based on inquiries by the Canadian Teachers’ Federation/Fédération canadienne des enseignantes et des enseignants (CTF/FCE), it appears that due to the combined effect of the late fall economic update that included the increased commitment, the late tabling of the bill to legislate the change and the minority government scenario, the government has been unable to pass this piece of legislation in the timeline they expected. As a result, teachers who claimed Line 46900 for their 2021 tax return should expect to see a delay of their Notice of Assessment.

The CTF/FCE has reached out to the Government of Canada to express their dissatisfaction that this expected delay was not communicated sooner and that other options outside of an indefinite delay until the Royal Assent of Bill C-8 were not explored. The CTF/FCE have written to staff in the Minister of Finance’s Office, the Minister of National Revenue’s Office and the Commissioner of Revenue’s Office. To date, only the Minister of National Revenue’s staff have responded and, while they recognized the severity of the issue and have agreed to provide support, they have encouraged the CTF/FCE to work directly with the Commissioner of Revenue.

If you are experiencing these delays, you are encouraged to contact the CTF/FCE’s Advocacy and Government Relations Coordinator, Mark Garcia via e-mail at [email protected].

Additionally, if you wish to express your concerns about these delays and the lack of communication from the CRA or the Government of Canada, you are encouraged to contact your local Member of Parliament to advocate for better channels of communication between the federal government and the CTF/FCE.

Eligible Educator School Supply Tax Credit (Line 46900)

Unfortunately, it appears that teachers who claimed Line 46900--Eligible educator school supply tax credit (Line 46900) on their 2021 tax return will experience delays with their Notice of Assessment (and subsequent refunds).

The Canada Revenue Agency (CRA) has informed teachers who have inquired about their returns that they would not be processing the 2021 tax returns for anyone who has claimed Line 46900 until the Royal Assent of Bill C-8 has been passed. Bill C-8 includes an increase in the School Supplies Tax Credit from 15 per cent to 25 per cent. Based on inquiries by the Canadian Teachers’ Federation/Fédération canadienne des enseignantes et des enseignants (CTF/FCE), it appears that due to the combined effect of the late fall economic update that included the increased commitment, the late tabling of the bill to legislate the change and the minority government scenario, the government has been unable to pass this piece of legislation in the timeline they expected. As a result, teachers who claimed Line 46900 for their 2021 tax return should expect to see a delay of their Notice of Assessment.

The CTF/FCE has reached out to the Government of Canada to express their dissatisfaction that this expected delay was not communicated sooner and that other options outside of an indefinite delay until the Royal Assent of Bill C-8 were not explored. The CTF/FCE have written to staff in the Minister of Finance’s Office, the Minister of National Revenue’s Office and the Commissioner of Revenue’s Office. To date, only the Minister of National Revenue’s staff have responded and, while they recognized the severity of the issue and have agreed to provide support, they have encouraged the CTF/FCE to work directly with the Commissioner of Revenue.

If you are experiencing these delays, you are encouraged to contact the CTF/FCE’s Advocacy and Government Relations Coordinator, Mark Garcia via e-mail at [email protected].

Additionally, if you wish to express your concerns about these delays and the lack of communication from the CRA or the Government of Canada, you are encouraged to contact your local Member of Parliament to advocate for better channels of communication between the federal government and the CTF/FCE.

WORTH KNOWING

Changes to Public Health Policy and School Safety

Alberta premier Jason Kenney has announced that effective Sunday, February 13, 2022, at 11:59 pm, the province will no longer require masking for children and youth in schools or for Albertans aged 12 and under in any setting. The target date for the second phase of the government’s plan is March 1, when the province plans to remove the remaining restrictions, including the indoor mask mandate, work-from-home requirements, remaining capacity limits, limits on social gatherings and screening for youth activities.

The abrupt changes during the latest COVID-19 provincial update have left Alberta teachers with many questions about the safety of their workplaces and their employers’ responsibilities. Here are some key points of information:

· School divisions are legally able to maintain a mask mandate; however, even if they maintain the mandate, divisions cannot refuse entry or access to students because of their individual and personal choice not to wear a mask.

· Amendments made to the Occupational Health and Safety Act (OHS Act) in December 2021 significantly changed the concept of dangerous work and the right to refuse dangerous work (section 17 of the OHS Act). Currently, the OHS Act enables workers to refuse work only if they reasonably believe that there is an undue hazard at the work site or that particular work poses an undue hazard to themselves or others.

o In this section of the OHS Act, “undue hazard” in relation to any occupation includes a hazard that poses a serious and immediate threat to the health and safety of a person.

o The act provides examples of undue hazards, such as

§ sudden infrastructure collapses that result in an unsafe physical environment or

§ a danger that would normally stop work, such as broken or damaged tools/equipment, or a gas leak.

· An undue hazard is a serious and immediate threat to health and safety that the refusing worker actually observes or experiences at their work site.

· In refusing the work, in s 17(3) of the OHS Act, the worker needs to ensure, as far as it is reasonable to do so, that the refusal does not endanger the health and safety of any other person. This could create a challenge for a teacher refusing the work and its impact on the students.

General health and safety concerns are not dealt with under the work refusal process, as they are not considered undue hazards. While a respiratory virus can be serious, it can be open to interpretation as to whether a respiratory illness is seen as a serious and immediate threat, particularly in the context of the experience gained with COVID-19. This is where the hazard assessment and controls come into play. A possible avenue to discuss the controls in place and to address potential refusals to perform work based on concerns related to coronavirus could be to work with the joint health and safety committee. Employers must work with the committee in responding to concerns.

What Can Teachers Do?

Alberta teachers can raise concerns about their work environment if they reasonably believe there is an “undue hazard.” They need to do this promptly and with their supervisor, who is likely the principal or the designated person on the health and safety committee.

Teachers can also reach out to their local and the health and safety committee and request that masking be discussed. Even with the changes announced by the Government of Alberta, employers are still required to conduct hazard assessments and use the suite of controls, which include

1. engineering controls—ventilation and physical barriers;

2. administrative controls—training, hand hygiene, physical distancing and so on; and

3. personal protective equipment (PPE).

Changes to Public Health Policy and School Safety

Alberta premier Jason Kenney has announced that effective Sunday, February 13, 2022, at 11:59 pm, the province will no longer require masking for children and youth in schools or for Albertans aged 12 and under in any setting. The target date for the second phase of the government’s plan is March 1, when the province plans to remove the remaining restrictions, including the indoor mask mandate, work-from-home requirements, remaining capacity limits, limits on social gatherings and screening for youth activities.

The abrupt changes during the latest COVID-19 provincial update have left Alberta teachers with many questions about the safety of their workplaces and their employers’ responsibilities. Here are some key points of information:

· School divisions are legally able to maintain a mask mandate; however, even if they maintain the mandate, divisions cannot refuse entry or access to students because of their individual and personal choice not to wear a mask.

· Amendments made to the Occupational Health and Safety Act (OHS Act) in December 2021 significantly changed the concept of dangerous work and the right to refuse dangerous work (section 17 of the OHS Act). Currently, the OHS Act enables workers to refuse work only if they reasonably believe that there is an undue hazard at the work site or that particular work poses an undue hazard to themselves or others.

o In this section of the OHS Act, “undue hazard” in relation to any occupation includes a hazard that poses a serious and immediate threat to the health and safety of a person.

o The act provides examples of undue hazards, such as

§ sudden infrastructure collapses that result in an unsafe physical environment or

§ a danger that would normally stop work, such as broken or damaged tools/equipment, or a gas leak.

· An undue hazard is a serious and immediate threat to health and safety that the refusing worker actually observes or experiences at their work site.

· In refusing the work, in s 17(3) of the OHS Act, the worker needs to ensure, as far as it is reasonable to do so, that the refusal does not endanger the health and safety of any other person. This could create a challenge for a teacher refusing the work and its impact on the students.

General health and safety concerns are not dealt with under the work refusal process, as they are not considered undue hazards. While a respiratory virus can be serious, it can be open to interpretation as to whether a respiratory illness is seen as a serious and immediate threat, particularly in the context of the experience gained with COVID-19. This is where the hazard assessment and controls come into play. A possible avenue to discuss the controls in place and to address potential refusals to perform work based on concerns related to coronavirus could be to work with the joint health and safety committee. Employers must work with the committee in responding to concerns.

What Can Teachers Do?

Alberta teachers can raise concerns about their work environment if they reasonably believe there is an “undue hazard.” They need to do this promptly and with their supervisor, who is likely the principal or the designated person on the health and safety committee.

- OHS requires the employer to remedy or stop work and inspect and, where possible, remedy the hazard immediately.

- If an inspection is completed, the employer must write a work refusal report. A copy of this report must be given to the teacher.

- The employer can require a refusing worker to resume work if the hazard has been remedied or if it has been assessed that there is no hazard and the work refusal report was shared with the worker.

Teachers can also reach out to their local and the health and safety committee and request that masking be discussed. Even with the changes announced by the Government of Alberta, employers are still required to conduct hazard assessments and use the suite of controls, which include

1. engineering controls—ventilation and physical barriers;

2. administrative controls—training, hand hygiene, physical distancing and so on; and

3. personal protective equipment (PPE).

WORTH KNOWING

Teacher Evaluations

Your principal will be formally evaluating your teaching practice. What does this mean? What do you need to do?

Teacher evaluation is a formal process of gathering information or evidence about a teacher’s competence in relation to the Teaching Quality Standard (TQS). While evaluation processes vary based on the context of the teacher’s teaching assignment, one way for an evaluation to take place is through several planned and unplanned classroom observations. Evaluation processes differ across the province based on each school division’s administrative procedures, but all school divisions must follow the provincial Teacher Growth, Supervision and Evaluation Policy framework.

The policy articulates that teacher evaluations may be conducted

(a) upon the written request of the teacher;

(b) for purposes of gathering information related to a specific employment decision;

(c) for purposes of assessing the growth of the teacher in specific areas of practice;

(d) when, on the basis of information received through supervision, the principal has reason to believe that the teaching of the teacher may not meet the teaching quality standard.

Teachers Without a Continuing Contract

Teachers without a continuing contract are often evaluated in accordance with reason (b) above. School divisions must evaluate teachers with probationary contracts to decide on their potential future employment. Depending on the school division’s teacher growth, supervision and evaluation administrative procedure, a teacher with a temporary contract may be evaluated for the same reason.

Teachers With a Continuing Contract

Teachers with a continuing contract are assumed competent because the division has already evaluated them when they worked on a probationary contract. Generally, teachers who have demonstrated competence during the supervision process are not evaluated. However, if the principal identifies concerns, an evaluation may be initiated in accordance with reason (d) above.

The Supervision Process

The supervision process that precedes a potential evaluation must focus on growth, support and guidance. If a principal has concerns about a teacher’s teaching practice, the principal should work with the teacher to identify the concerns and offer feedback, guidance and support. Ideally, the teacher would respond appropriately to these concerns and make changes to their practice accordingly. It is only after unsuccessful attempts to improve the teacher’s practice that a principal may initiate an evaluation. If you are a continuing contract teacher and your principal wants to formally evaluate your teaching practice without identifying any areas of concern or offering to support and guide your practice, an evaluation may be premature. Call Teacher Employment Services (TES) for advice.

The provincial Teacher Growth, Supervision and Evaluation Policy identifies several processes that school divisions must follow when a principal conducts a teacher evaluation to ensure that the evaluation is fair and provides a clear, stable, achievable target for the teacher to achieve. For example, a principal must explicitly communicate to the teacher the reasons for and purposes of the evaluation; the process, criteria and standards to be used; the timelines to be applied; and the possible outcomes. While the provincial policy provides these safeguards for teachers, it does not dictate the exact process that must be used. More specific processes, such as a minimum number of individual classroom observations or applicable time frames, are generally found in the school division’s administrative procedure.

At the conclusion of an evaluation, the teacher should receive a copy of the completed evaluation report that includes the information and evidence that were collected, identifies areas of strength and growth, and shows how the evidence applies to the TQS and whether the teacher’s practice meets the TQS. When being presented with this evaluation report, teachers should also be provided with the opportunity to share their thoughts. Sometimes the report requires a teacher’s signature, which does not mean that they agree with all of its contents but rather confirms that they have received a copy.

Next Steps After an Evaluation

For teachers with continuing contracts, the outcome of the evaluation generally informs the next steps. If the teacher meets the TQS, the evaluation process ends and the principal’s usual supervisory practices would follow. If the TQS is not met, a period of remediation with significant, targeted supports should follow. Call TES for any questions regarding remediation.

For teachers with probationary contracts, it is common for the principal to recommend potential future employment status with the school division. Because staffing is based on various factors, this recommendation is not a guarantee of employment.

Teachers have the right to Association advice throughout the entire process. If you have any questions about an evaluation or the process of supervision that you believe may be leading to an evaluation, please call TES for advice tailored to your specific circumstances.

Teacher Evaluations

Your principal will be formally evaluating your teaching practice. What does this mean? What do you need to do?

Teacher evaluation is a formal process of gathering information or evidence about a teacher’s competence in relation to the Teaching Quality Standard (TQS). While evaluation processes vary based on the context of the teacher’s teaching assignment, one way for an evaluation to take place is through several planned and unplanned classroom observations. Evaluation processes differ across the province based on each school division’s administrative procedures, but all school divisions must follow the provincial Teacher Growth, Supervision and Evaluation Policy framework.

The policy articulates that teacher evaluations may be conducted

(a) upon the written request of the teacher;

(b) for purposes of gathering information related to a specific employment decision;

(c) for purposes of assessing the growth of the teacher in specific areas of practice;

(d) when, on the basis of information received through supervision, the principal has reason to believe that the teaching of the teacher may not meet the teaching quality standard.

Teachers Without a Continuing Contract

Teachers without a continuing contract are often evaluated in accordance with reason (b) above. School divisions must evaluate teachers with probationary contracts to decide on their potential future employment. Depending on the school division’s teacher growth, supervision and evaluation administrative procedure, a teacher with a temporary contract may be evaluated for the same reason.

Teachers With a Continuing Contract

Teachers with a continuing contract are assumed competent because the division has already evaluated them when they worked on a probationary contract. Generally, teachers who have demonstrated competence during the supervision process are not evaluated. However, if the principal identifies concerns, an evaluation may be initiated in accordance with reason (d) above.

The Supervision Process

The supervision process that precedes a potential evaluation must focus on growth, support and guidance. If a principal has concerns about a teacher’s teaching practice, the principal should work with the teacher to identify the concerns and offer feedback, guidance and support. Ideally, the teacher would respond appropriately to these concerns and make changes to their practice accordingly. It is only after unsuccessful attempts to improve the teacher’s practice that a principal may initiate an evaluation. If you are a continuing contract teacher and your principal wants to formally evaluate your teaching practice without identifying any areas of concern or offering to support and guide your practice, an evaluation may be premature. Call Teacher Employment Services (TES) for advice.

The provincial Teacher Growth, Supervision and Evaluation Policy identifies several processes that school divisions must follow when a principal conducts a teacher evaluation to ensure that the evaluation is fair and provides a clear, stable, achievable target for the teacher to achieve. For example, a principal must explicitly communicate to the teacher the reasons for and purposes of the evaluation; the process, criteria and standards to be used; the timelines to be applied; and the possible outcomes. While the provincial policy provides these safeguards for teachers, it does not dictate the exact process that must be used. More specific processes, such as a minimum number of individual classroom observations or applicable time frames, are generally found in the school division’s administrative procedure.

At the conclusion of an evaluation, the teacher should receive a copy of the completed evaluation report that includes the information and evidence that were collected, identifies areas of strength and growth, and shows how the evidence applies to the TQS and whether the teacher’s practice meets the TQS. When being presented with this evaluation report, teachers should also be provided with the opportunity to share their thoughts. Sometimes the report requires a teacher’s signature, which does not mean that they agree with all of its contents but rather confirms that they have received a copy.

Next Steps After an Evaluation

For teachers with continuing contracts, the outcome of the evaluation generally informs the next steps. If the teacher meets the TQS, the evaluation process ends and the principal’s usual supervisory practices would follow. If the TQS is not met, a period of remediation with significant, targeted supports should follow. Call TES for any questions regarding remediation.

For teachers with probationary contracts, it is common for the principal to recommend potential future employment status with the school division. Because staffing is based on various factors, this recommendation is not a guarantee of employment.

Teachers have the right to Association advice throughout the entire process. If you have any questions about an evaluation or the process of supervision that you believe may be leading to an evaluation, please call TES for advice tailored to your specific circumstances.

WORTH KNOWING

Teachers and Violence in the Workplace

Part 27 of the Occupational Health and Safety Code identifies violence as a workplace hazard, and it is defined as “the threatened, attempted or actual conduct of a person that causes or is likely to cause physical injury.”

Examples of workplace violence follow

· threatening behaviour such as shaking fists, destroying property or throwing objects;

· verbal or written threats (any expression of intent to cause harm); and

· physical attacks such as hitting, shoving, pushing or kicking.

Teachers may face violence while at work in various ways. Unfortunately, it is becoming common for teachers to experience violence when dealing with students who have behavioural difficulties. Teachers may also face violence from parents, colleagues and members of the public, and by being in close proximity to an altercation between other people.

The first step is to ensure that violence is recognized as a hazard on the hazard assessment. It is important to note that the potential behaviour is the hazard, not a specific person. A hazard assessment applies to the entire work site, not just a classroom or a situation where a student with violent behaviour has been identified. It is also possible that in a work site where no student with violent behaviour has been identified, that work site may experience a violent event, and that possibility must be noted on a hazard assessment.

When a hazard is observed, the teacher must evaluate their own risk regarding the potential frequency exposure to the hazard as well as the potential severity of any injury as a result of the hazard. This level of risk may be different for each individual teacher depending on their circumstance and assignment.

Like many workplace hazards, elimination is ideal but may not be possible. Therefore, controls must be identified and implemented to mitigate the risk associated with the hazard to the highest degree possible. Hazard assessments and the identification of controls require participation by all work site parties affected by the hazard.

The first choice of these controls is to engineer the workplace to isolate people from the hazard. For example, school doors are often locked, and visitors must check in at the office. In a classroom, the configuration of furniture and placement of the teacher’s desk and workspace should reduce a student’s ability to aggressively approach the teacher.

If the hazard cannot be controlled by engineering alone, adding administrative controls is the next choice. This involves changing how people work and implementing procedures. When working with a student with behavioural challenges, many of the administrative controls should be found in the student’s behaviour support plan. This may include a process for intervention from administration or the student’s parents.

Finally, if the hazard is still not controlled, personal protective equipment is added to the suite of controls in place. This includes any equipment that would act as a barrier between the teacher and the student so that if the student becomes aggressive, injury to the teacher would be unlikely.

Often, hazards are controlled by a combination of engineering controls, administrative controls and personal protective equipment. If a teacher believes that the hazards are not being adequately controlled, they should contact Teacher Employment Services (TES) for advice (1‑800‑232‑7208).

Everyone at the school must follow the protocols put in place to control identified hazards. As well, any concerns about unsafe conditions or controls that are not working or not being followed must be promptly communicated to the principal. This can result in a review of the hazard assessment and a modification of the controls in place, helping to ensure the health and safety of everyone at the school.

Teachers and Violence in the Workplace

Part 27 of the Occupational Health and Safety Code identifies violence as a workplace hazard, and it is defined as “the threatened, attempted or actual conduct of a person that causes or is likely to cause physical injury.”

Examples of workplace violence follow

· threatening behaviour such as shaking fists, destroying property or throwing objects;

· verbal or written threats (any expression of intent to cause harm); and

· physical attacks such as hitting, shoving, pushing or kicking.

Teachers may face violence while at work in various ways. Unfortunately, it is becoming common for teachers to experience violence when dealing with students who have behavioural difficulties. Teachers may also face violence from parents, colleagues and members of the public, and by being in close proximity to an altercation between other people.

The first step is to ensure that violence is recognized as a hazard on the hazard assessment. It is important to note that the potential behaviour is the hazard, not a specific person. A hazard assessment applies to the entire work site, not just a classroom or a situation where a student with violent behaviour has been identified. It is also possible that in a work site where no student with violent behaviour has been identified, that work site may experience a violent event, and that possibility must be noted on a hazard assessment.

When a hazard is observed, the teacher must evaluate their own risk regarding the potential frequency exposure to the hazard as well as the potential severity of any injury as a result of the hazard. This level of risk may be different for each individual teacher depending on their circumstance and assignment.

Like many workplace hazards, elimination is ideal but may not be possible. Therefore, controls must be identified and implemented to mitigate the risk associated with the hazard to the highest degree possible. Hazard assessments and the identification of controls require participation by all work site parties affected by the hazard.

The first choice of these controls is to engineer the workplace to isolate people from the hazard. For example, school doors are often locked, and visitors must check in at the office. In a classroom, the configuration of furniture and placement of the teacher’s desk and workspace should reduce a student’s ability to aggressively approach the teacher.

If the hazard cannot be controlled by engineering alone, adding administrative controls is the next choice. This involves changing how people work and implementing procedures. When working with a student with behavioural challenges, many of the administrative controls should be found in the student’s behaviour support plan. This may include a process for intervention from administration or the student’s parents.

Finally, if the hazard is still not controlled, personal protective equipment is added to the suite of controls in place. This includes any equipment that would act as a barrier between the teacher and the student so that if the student becomes aggressive, injury to the teacher would be unlikely.

Often, hazards are controlled by a combination of engineering controls, administrative controls and personal protective equipment. If a teacher believes that the hazards are not being adequately controlled, they should contact Teacher Employment Services (TES) for advice (1‑800‑232‑7208).

Everyone at the school must follow the protocols put in place to control identified hazards. As well, any concerns about unsafe conditions or controls that are not working or not being followed must be promptly communicated to the principal. This can result in a review of the hazard assessment and a modification of the controls in place, helping to ensure the health and safety of everyone at the school.

WORTH KNOWING

Travelling During a Pandemic (Information as of 2021-11-01)

With borders reopening and the holiday season fast approaching, information to assist teachers with decision making related to travel is important. An employer cannot direct what teachers do on their personal time. A decision to travel may have consequences, but that decision remains with the teacher. As always, the Association advises teachers to call for assistance with personal situations, as every situation may be slightly different.

Alberta Health Services (AHS) guidelines and restrictions remain in effect and can be found at www.albertahealthservices.ca. As well, travel advisories greatly affect travel plans, and it is the traveller’s responsibility to check on these. Remember that not only are there international travel restrictions, but there are also provincial restrictions. These restrictions continue to change. Be sure to check on all travel advisories at https://travel.gc.ca/travelling/advisories.

Here are some questions you should consider:

· What is the destination country’s vaccine requirement?

· What documentation do you need upon arrival or departure?

· What is required if you start to exhibit COVID-19 symptoms?

· What is your plan if self-isolation is required, either upon arriving at your destination or upon returning to Canada?

Some of these requirements may affect your ability to return to work after the holiday and may exacerbate potential issues with your employer.

If you are sick, for whatever reason, you are entitled to sick leave provisions in your collective agreement. If you are required to quarantine because you are exhibiting symptoms and are sick, you are entitled to sick leave as per your collective agreement. (Some teachers have 90 days and some have statutory sick leave of 20 days per year.) Sick leave entitlement is not affected by travel in any way.

Problems with a return to work as the result of other issues (such as a delayed flight) are managed with collective agreement days off, such as personal days or days off without pay. If you are not sick but are required to quarantine, you must take that time without pay, as travel is a personal choice and is unpredictable at this time, or use applicable leaves in your collective agreement (such as personal days) for the quarantine period.

As for benefits and travel, some aspects of your medical coverage may not be in effect if you travel internationally when advised not to do so. Check with your medical benefits insurer for the specific details of your plan. If you have Alberta School Employee Benefit Plan (ASEBP) coverage, contact ASEBP before you travel and review the details at www.asebp.ca/my-benefits. If you are a teacher with coverage other than ASEBP, contact your benefits provider before travelling to ensure that, in the current conditions, you are covered for all aspects of the trip (from quarantine costs, such as hotel rooms, to costs related to having to change flights).

Further information or assistance is available by calling Teacher Employment Services at 1‑800‑232‑7208.

Travelling During a Pandemic (Information as of 2021-11-01)

With borders reopening and the holiday season fast approaching, information to assist teachers with decision making related to travel is important. An employer cannot direct what teachers do on their personal time. A decision to travel may have consequences, but that decision remains with the teacher. As always, the Association advises teachers to call for assistance with personal situations, as every situation may be slightly different.

Alberta Health Services (AHS) guidelines and restrictions remain in effect and can be found at www.albertahealthservices.ca. As well, travel advisories greatly affect travel plans, and it is the traveller’s responsibility to check on these. Remember that not only are there international travel restrictions, but there are also provincial restrictions. These restrictions continue to change. Be sure to check on all travel advisories at https://travel.gc.ca/travelling/advisories.

Here are some questions you should consider:

· What is the destination country’s vaccine requirement?

· What documentation do you need upon arrival or departure?

· What is required if you start to exhibit COVID-19 symptoms?

· What is your plan if self-isolation is required, either upon arriving at your destination or upon returning to Canada?

Some of these requirements may affect your ability to return to work after the holiday and may exacerbate potential issues with your employer.

If you are sick, for whatever reason, you are entitled to sick leave provisions in your collective agreement. If you are required to quarantine because you are exhibiting symptoms and are sick, you are entitled to sick leave as per your collective agreement. (Some teachers have 90 days and some have statutory sick leave of 20 days per year.) Sick leave entitlement is not affected by travel in any way.

Problems with a return to work as the result of other issues (such as a delayed flight) are managed with collective agreement days off, such as personal days or days off without pay. If you are not sick but are required to quarantine, you must take that time without pay, as travel is a personal choice and is unpredictable at this time, or use applicable leaves in your collective agreement (such as personal days) for the quarantine period.

As for benefits and travel, some aspects of your medical coverage may not be in effect if you travel internationally when advised not to do so. Check with your medical benefits insurer for the specific details of your plan. If you have Alberta School Employee Benefit Plan (ASEBP) coverage, contact ASEBP before you travel and review the details at www.asebp.ca/my-benefits. If you are a teacher with coverage other than ASEBP, contact your benefits provider before travelling to ensure that, in the current conditions, you are covered for all aspects of the trip (from quarantine costs, such as hotel rooms, to costs related to having to change flights).

Further information or assistance is available by calling Teacher Employment Services at 1‑800‑232‑7208.

WORTH DOING

Moneytalk: Q&A

Short on time? Want to cut straight to the chase? Attend a brief Zoom meeting to have your money questions answered!

Moneytalk: Q&A is a half-hour session dedicated to your financial questions. Here are just a few examples of those burning questions you’d love to have answered:

Should I purchase an RRSP, or should I go with a TFSA instead?

How does the Home Buyers’ Plan work?

Wait—the government will give me money for my RESP?

Capital Estate Planning—the people who brought you the ATA Financial Wellness sessions last year—will provide expert advice on these questions and more.

Rick Harcourt, Professional Financial Advisor, manages the ATA Voluntary Benefit Program for Capital Estate Planning. He has been the featured speaker at the ATA Financial Wellness sessions and provincewide pre-retirement workshops.

The Moneytalk: Q&A session is free and will be held 4:00–4:30 pm on November 24, 2021, and February 9, 2022.

Register for the date of your choice here:

November 24, 2021: Register here. February 9, 2022: Register here.

A Zoom link will be sent to all registrants closer to the date of the session.

Moneytalk: Q&A

Short on time? Want to cut straight to the chase? Attend a brief Zoom meeting to have your money questions answered!

Moneytalk: Q&A is a half-hour session dedicated to your financial questions. Here are just a few examples of those burning questions you’d love to have answered:

Should I purchase an RRSP, or should I go with a TFSA instead?

How does the Home Buyers’ Plan work?

Wait—the government will give me money for my RESP?

Capital Estate Planning—the people who brought you the ATA Financial Wellness sessions last year—will provide expert advice on these questions and more.

Rick Harcourt, Professional Financial Advisor, manages the ATA Voluntary Benefit Program for Capital Estate Planning. He has been the featured speaker at the ATA Financial Wellness sessions and provincewide pre-retirement workshops.

The Moneytalk: Q&A session is free and will be held 4:00–4:30 pm on November 24, 2021, and February 9, 2022.

Register for the date of your choice here:

November 24, 2021: Register here. February 9, 2022: Register here.

A Zoom link will be sent to all registrants closer to the date of the session.

WORTH KNOWING

Changes to Employment Insurance

The employment insurance system has been amended as of September 26, 2021. Many of the key changes will apply only to new claims made for benefits beginning September 26, 2021 and are still pandemic related.

Eligibility

Teachers applying for employment insurance (EI) will need to have worked a minimum number of hours to qualify for benefits. Previously, teachers needed 600 hours to qualify for maternity or parental benefits; if they applied for regular benefits, the number of insurable hours required to qualify varied in different parts of the province, based on local labour market conditions.

Over the last year, all new EI applicants received a one-time hours top-up to help them qualify, but this requirement has been amended. As a result, teachers will need to have accumulated 420 hours of insurable employment during their qualifying period to be eligible for EI benefits until September 24, 2022.

Further, to access EI sickness benefits, teachers will now be required to submit a medical certificate proving they are ill and unable to work. The requirement was waived temporarily over the last year because of COVID-19.

Maternity and Parental Benefits

Employment Insurance maternity and parental benefits entitle teachers to receive 55 per cent of their earnings, to a maximum of $595 per week. If a teacher’s claim starts between September 26, 2021 and November 20, 2021, the teacher will receive at least $300 per week before taxes, but could receive more. For extended parental benefits, teachers will receive at least $180 per week before taxes, but could also receive more. The weekly floor is planned to apply to claims made between September 26 and November 20.

No one with an existing EI claim will experience any changes to the value or duration of their benefits under these new rules.

Changes to Employment Insurance

The employment insurance system has been amended as of September 26, 2021. Many of the key changes will apply only to new claims made for benefits beginning September 26, 2021 and are still pandemic related.

Eligibility

Teachers applying for employment insurance (EI) will need to have worked a minimum number of hours to qualify for benefits. Previously, teachers needed 600 hours to qualify for maternity or parental benefits; if they applied for regular benefits, the number of insurable hours required to qualify varied in different parts of the province, based on local labour market conditions.

Over the last year, all new EI applicants received a one-time hours top-up to help them qualify, but this requirement has been amended. As a result, teachers will need to have accumulated 420 hours of insurable employment during their qualifying period to be eligible for EI benefits until September 24, 2022.

Further, to access EI sickness benefits, teachers will now be required to submit a medical certificate proving they are ill and unable to work. The requirement was waived temporarily over the last year because of COVID-19.

Maternity and Parental Benefits

Employment Insurance maternity and parental benefits entitle teachers to receive 55 per cent of their earnings, to a maximum of $595 per week. If a teacher’s claim starts between September 26, 2021 and November 20, 2021, the teacher will receive at least $300 per week before taxes, but could receive more. For extended parental benefits, teachers will receive at least $180 per week before taxes, but could also receive more. The weekly floor is planned to apply to claims made between September 26 and November 20.

No one with an existing EI claim will experience any changes to the value or duration of their benefits under these new rules.

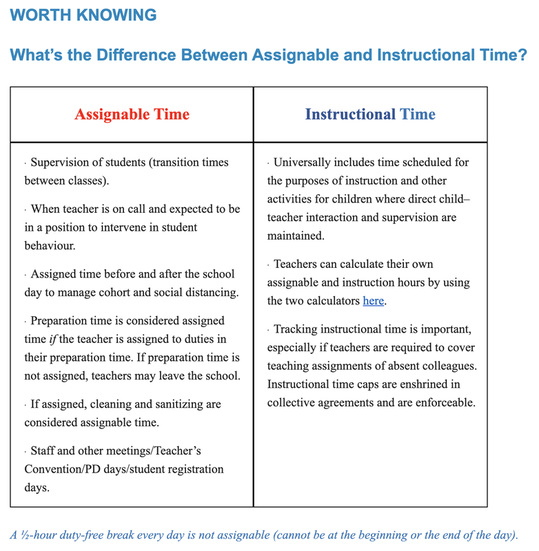

Which teachers have assignable time limits?

Any teacher whose primary function is to provide instruction to students is subject to the applicable teacher instructional and assignable time limits. This includes lead teachers and teachers who are in receipt of an allowance but who do not have administrative designations. Part-time teachers are prorated on the average instructional time of a teacher at that school. Refer to your collective agreement for times, or call Teacher Employment Services at 1‑800‑232‑7208.

Which teachers are not subject to assignable time limits?

These are teachers with administrative designations whose primary function is not instruction, including those teachers who have principal in their titles (that is, principals, vice-principals, assistant principals). Central office staff (for example, psychologist, director of special education, interschool coordinator) may not be subject to the time limits, provided that their primary function is not instruction of students.

Which teachers are subject to the instructional time limits?

• Any teacher whose primary function is to provide instruction to students is subject to the applicable teacher instructional and assignable time limits.

• This includes lead teachers and teachers in receipt of an allowance but who do not have administrative designations.

• This also includes teachers who are supervising the instruction provided by another certificated teacher or nonteacher (for example, preservice teacher or instructor of students in the Registered Apprentice Program).

Any teacher whose primary function is to provide instruction to students is subject to the applicable teacher instructional and assignable time limits. This includes lead teachers and teachers who are in receipt of an allowance but who do not have administrative designations. Part-time teachers are prorated on the average instructional time of a teacher at that school. Refer to your collective agreement for times, or call Teacher Employment Services at 1‑800‑232‑7208.

Which teachers are not subject to assignable time limits?

These are teachers with administrative designations whose primary function is not instruction, including those teachers who have principal in their titles (that is, principals, vice-principals, assistant principals). Central office staff (for example, psychologist, director of special education, interschool coordinator) may not be subject to the time limits, provided that their primary function is not instruction of students.

Which teachers are subject to the instructional time limits?

• Any teacher whose primary function is to provide instruction to students is subject to the applicable teacher instructional and assignable time limits.

• This includes lead teachers and teachers in receipt of an allowance but who do not have administrative designations.

• This also includes teachers who are supervising the instruction provided by another certificated teacher or nonteacher (for example, preservice teacher or instructor of students in the Registered Apprentice Program).